Profitability Meaning

Profitability is the ability of a company or business to generate revenue over and above its expenses and is usually measured using ratios like gross profit margin, net profit margin EBITDA, etc. These ratios help analysts, shareholders, and stakeholders to analyze and measure the company's ability to generate revenue to cover its operational cost Operating expense (OPEX) is the cost incurred in the normal course of business and does not include expenses directly related to product manufacturing or service delivery. Therefore, they are readily available in the income statement and help to determine the net profit. read more , create value by adding assets to balance sheet A balance sheet is one of the financial statements of a company that presents the shareholders' equity, liabilities, and assets of the company at a specific point in time. It is based on the accounting equation that states that the sum of the total liabilities and the owner's capital equals the total assets of the company. read more and analyze its ability to expand and take up projects for its future growth.

- The higher the ratio, the better it is as it means the company is performing well.

- These ratios are often used to compare the performance of companies against each other.

- Profitability is not only used by business owners, but also by investment analysts An investment analyst is an individual or firm that excels in the financial and investment research and have a keen knowledge of financial instruments and models. Such financial professionals include portfolio managers, investment advisors, brokerage firms, mutual fund companies, investment banks, etc. read more to determine whether it's wise to invest or not considering it current and future growth.

How to Analyze Profitability?

Let's take an example of profitability.

You are free to use this image on your website, templates etc, Please provide us with an attribution link Article Link to be Hyperlinked

For eg:

Source: Profitability (wallstreetmojo.com)

You can download this Profitability Excel Template here – Profitability Excel Template

- Sales = $50,000

- Purchase = $30,000

- Direct Costs Direct costs are costs incurred by an organization while performing its core business activity and can be attributed directly in the production cost, such as raw material costs, wages paid to factory staff, power & fuel expenses in a factory, and so on, but do not include indirect costs such as advertisement costs, administrative costs, etc. read more = $500

- Rent = $1,000

- Salary = $3,000

- General Expenses = $1,500

- Depreciation = $500

- Interest Paid = $200

- Taxes @ 30% = 3,990

Profit = $ (50,000-30,000-500-1,000-3,000-1,500-500-200-3,990)

Profit = $9,310

Let us calculate most commonly used ratios to calculate profitability

#1 – Gross Profit Margin

Gross Profit Margin Gross Profit Margin is the ratio that calculates the profitability of the company after deducting the direct cost of goods sold from the revenue and is expressed as a percentage of sales. It doesn't include any other expenses into account except the cost of goods sold. read more is a ratio of gross profit to sales, which means if the entity is able to recover its cost of production from the revenue it's earning. Higher the ratio, the better it is.

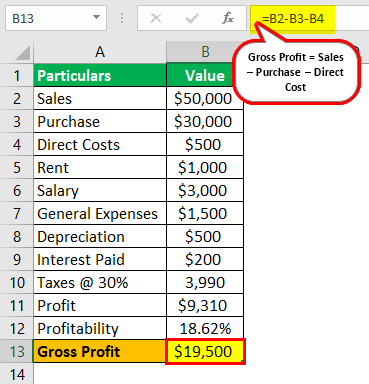

As per the above example:

Calculation of Gross Profit will be –

Gross Profit = Sales – Purchase – Direct Cost

Gross Profit = $(50,000-30,000-500)

Gross Profit = $19,500

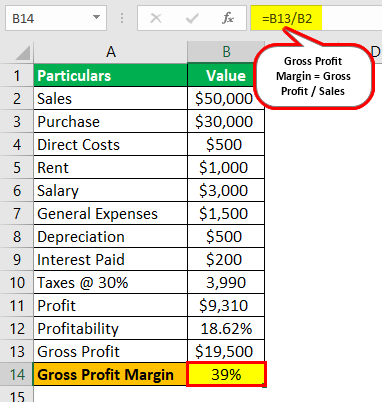

Calculation of Gross Profit Margin will be –

Gross Profit Margin = Gross Profit / Sales

Gross Profit Margin = 19,500/50,000

Gross Profit Margin = 39%

#2 – Net Profit Margin

Net Profit Margin Net profit margin is the percentage of net income a company derives from its net sales. It indicates the organization's overall profitability after incurring its interest and tax expenses. read more a ratio of net profit to sales. Net profit is the profit earned after reducing operational costs, depreciation, and dividend from gross profit. A higher ratio/margin means the company is earning well enough to not only cover all its cost but all payout to its shareholder or re-invest its profit for growth.

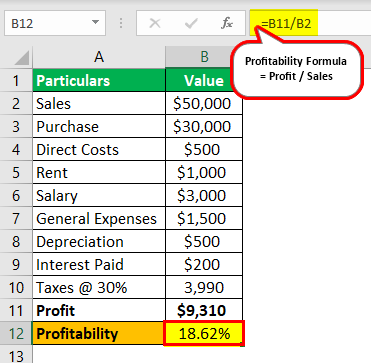

Profitability = $9,310 / 50,000

= 18.62%

As calculated above, the net profit margin is 18.62%.

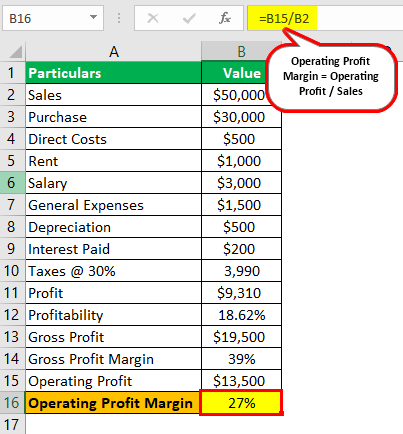

#3 – Operation Profit Margin

Operating Profit Margin Operating Profit Margin is the profitability ratio which is used to determine the percentage of the profit which the company generates from its operations before deducting the taxes and the interest and is calculated by dividing the operating profit of the company by its net sales. read more a percentage of earnings to sales before interest expense and income taxes. A higher margin means companies are well equipped to pay for its fixed and operational costs. It also indicates efficient management and their ability to survive in economic downtime compared to their competitors.

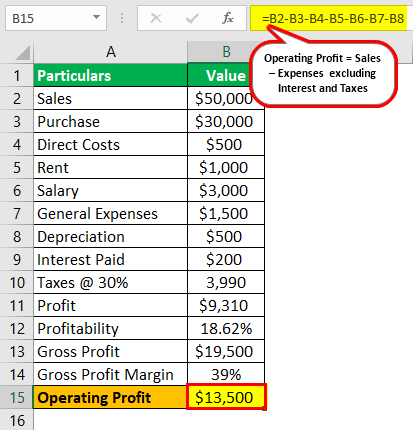

As per the above example:

Calculation of Operating Profit will be –

Operating Profit = Sales – Expenses excluding Interest and Taxes

Operating Profit = $(50,000-30,000-500-1,000-3,000-1,500-500)

Operating Profit = $13,500

Calculation of Operating Profit Margin will be –

Operating Profit Margin = Operating Profit / Sales

Operating Profit Margin = 13,500/50,000

Operating Profit Margin =27%

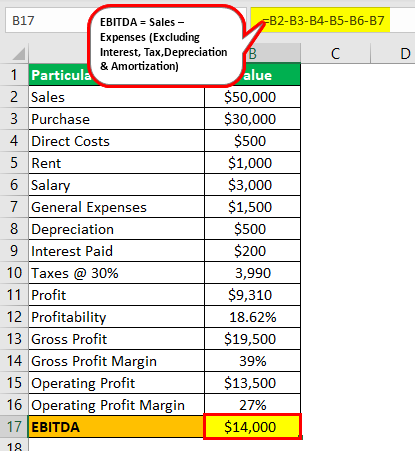

#4 – EBITDA

Its earnings before interest, tax, depreciation, and amortization. EBITDA EBITDA refers to earnings of the business before deducting interest expense, tax expense, depreciation and amortization expenses, and is used to see the actual business earnings and performance-based only from the core operations of the business, as well as to compare the business's performance with that of its competitors. read more is commonly used to compare a companies performance with others and is widely used in valuation and project financing.

As per the above example:

Calculation of EBITDA will be –

EBITDA = Sales – Expenses (Excluding Interest, Tax, Depreciation, and Amortization)

EBITDA = $ (50,000-30,000-500-1,000-3,000-1,500)

EBITDA = $14,000

Advantages

Some of the advantages are as follows:

- Profitability helps us in determining the pricing of our product and services and, in many cases, if any revision is required. Pricing is very important for any business, as it not only leads to increases in net revenue Net revenue refers to a company's sales realization acquired after deducting all the directly related selling expenses such as discount, return and other such costs from the gross sales revenue it generated. read more , but it also has to be at a close level with competitors. It helps in pricing strategy.

- Higher profitability is directly related to higher sales. The various ratios and metrics which are used help in comparing past data and analyze if the company can survive in a downtime.

- It helps us in analyzing the return of investment from a business. This means how effectively the company issuing its resources to generate value and profit. It lets us know if the resources are properly deployed and if it can sustain in the future.

Disadvantages

Some of the disadvantages are as follows:

- Does not predict company performance in the future accurately as companies often window dress their accounting statements.

- Cannot compare companies performance across different industries. For example, the analysis of comparing pharmaceuticals with the FMCG industry wouldn't be accurate.

Profitability ratios are key indicators to analyze the performance and liquidity of the company and are derived using income statements. It is also used to determine the strengths and weaknesses of a business and also how companies achieve profit from their operations. Analyst use ratios to determine whether it's a good proposal for investment purposes and banking institutions use such ratios to often determine the creditworthiness of a company and sanction loans based on such ratios. Amongst other ratios, profitability ratios are of utmost importance as all businesses ultimately focus on earning profit and creating value for its stakeholders.

Recommended Articles

This article has been a guide to what is profitability and its meaning. Here we discuss the formula to calculate profitability along with examples, advantages, and disadvantages. You can learn more about valuation from the following articles –

- Operating Profit Formula

- EBITDA Margin Calculation

- Formula of Return on Sales

Source: https://www.wallstreetmojo.com/profitability/

Posted by: sabinasamicke0194875.blogspot.com

Post a Comment